35+ Credit card payoff calculator chart

The Credit Card Payment Calculator allows you to choose one of two payment methods. A credit card payment calculator is just one tool that may prove to be useful when you want to find out just how long it could take to pay off your debt.

Do Millennials Prefer Debit Cards To Credit Cards What Does The Evidence Say Quora

Some cards can charge a fee of 3 or 4 of the total amount.

. Check out our credit card payoff chart selection for the very best in unique or custom handmade pieces from our shops. In many cases a credit card company will charge a percentage of the. Credit card balance - the amount you own credit card company.

Cards interest rate - interest rate by year expressed as a percentage. Take Control of Your Debts. The amount of time it takes to pay off credit card debt depends on a combination of factors including how much debt you have the interest youre paying on that debt how much.

Using a credit card payoff calculator can help. Ad Get Assistance Managing Which Debts to Pay First and How Much to Pay. The credit card payoff calculator below can give you estimates as you develop a plan to pay off credit card debt.

There are 2 cases to be noted while using a Credit Card Payoff Calculator. Get Step-by-Step Guidance with AARP Money Map. Credit Card Payoff Calculator Easily see what it will take to pay off your credit card at different interest rates and payment amounts with this credit card payoff calculator.

Note that this is not the same as the credit cards required minimum payment. Using the credit card payoff calculator. Heres a breakdown of how each debt consolidation.

So if you owe 2000 your minimum payment might be 40. This is the amount you plan to pay toward your credit card debt each month. Understand your monthly budget and how much you can spend monthly on your credit card debt.

The minimum payment is the amount of money you have to pay if you have a balance on your credit card account. Depending on the calculator you can. Pay off your credit cards by using a fixed monthly payment you can afford.

The interest-free period is generally 6-21 months after which the credit card will require payment of interest on top of the principal. There is usually a dollar. Consolidating credit card debt involves paying off your existing debt with a new credit card or personal loan preferably with better terms.

Typically the minimum payment is a percentage of your total current balance plus any interest you owe.

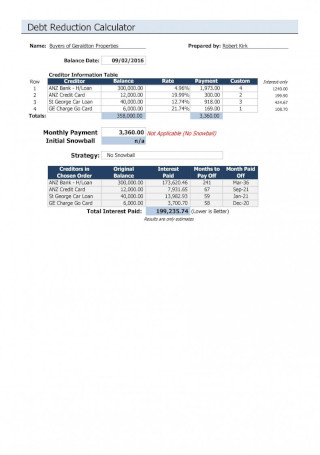

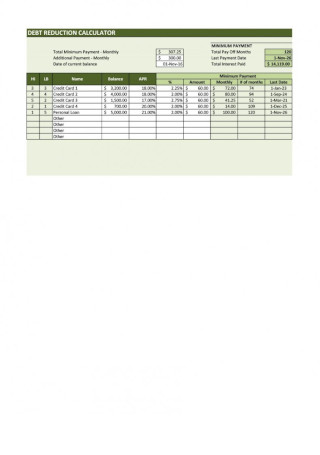

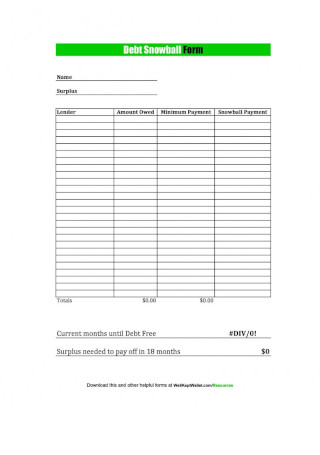

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

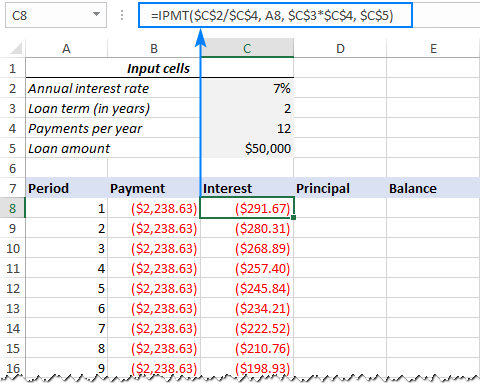

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Slide 33 Jpg

Do Millennials Prefer Debit Cards To Credit Cards What Does The Evidence Say Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Amazon Com Bambo Nature Overnight Eco Friendly Baby Diapers Size 6 White 20 Count Baby

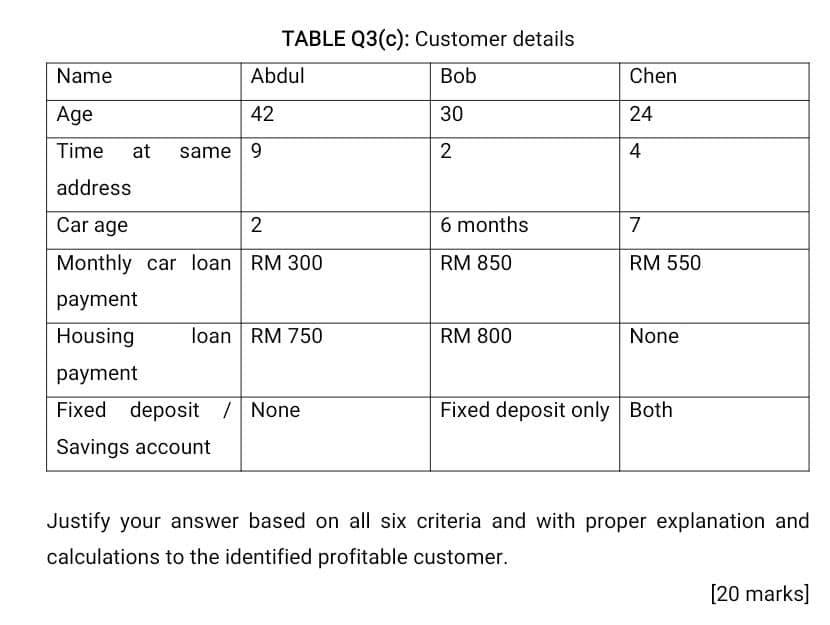

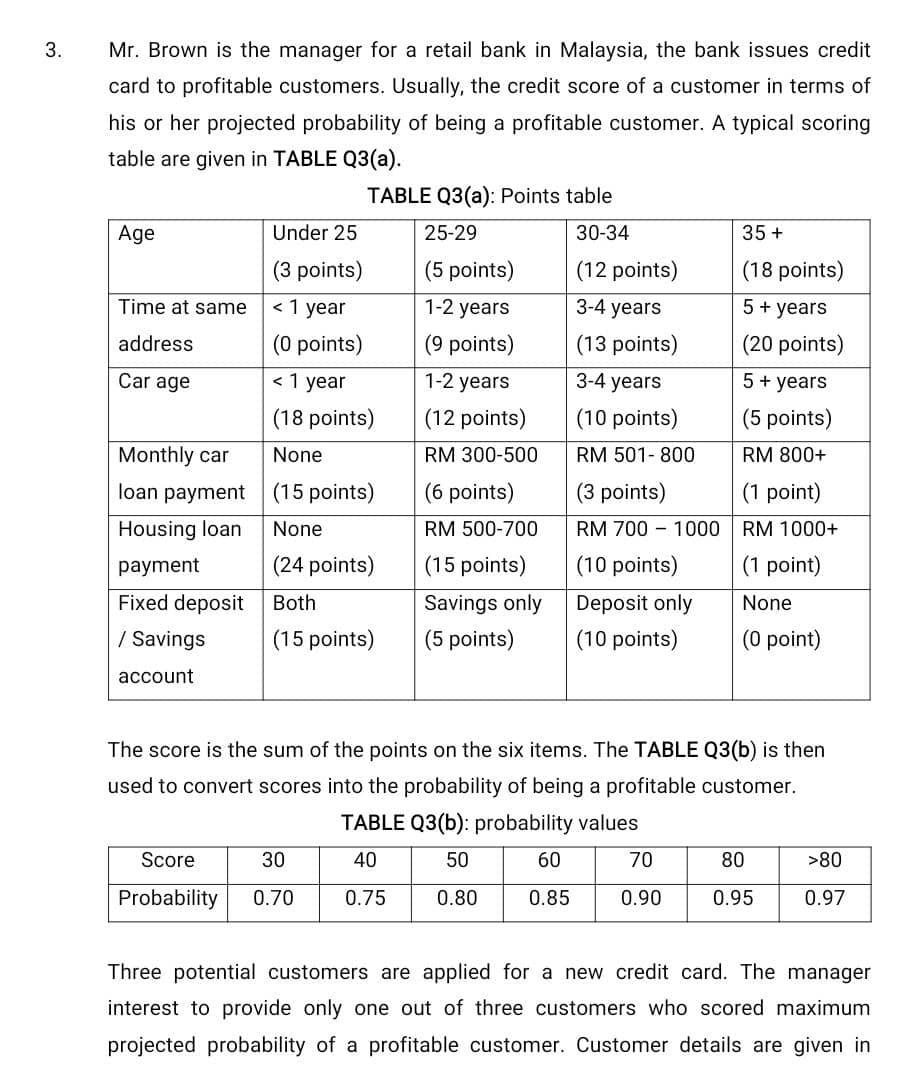

Solved 3 Mr Brown Is The Manager For A Retail Bank In Chegg Com

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Square Review Fees Complaints Lawsuits Comparisons

Solved 3 Mr Brown Is The Manager For A Retail Bank In Chegg Com